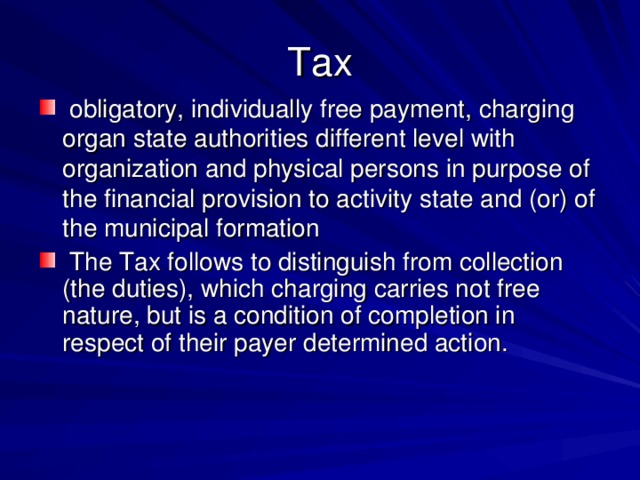

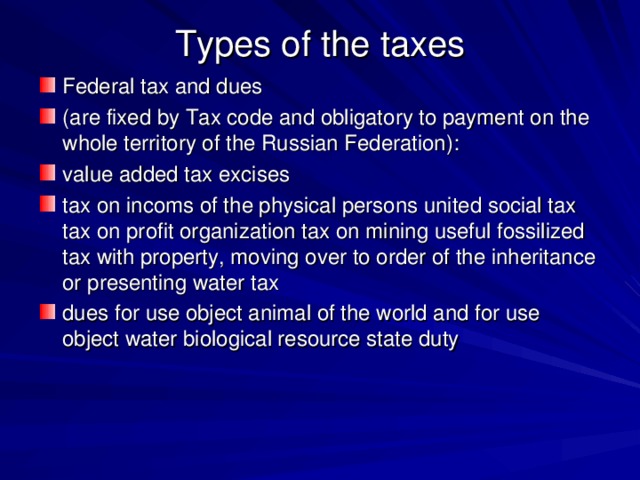

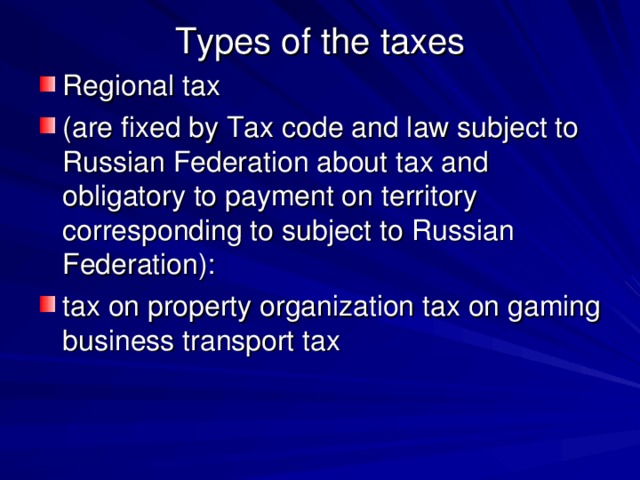

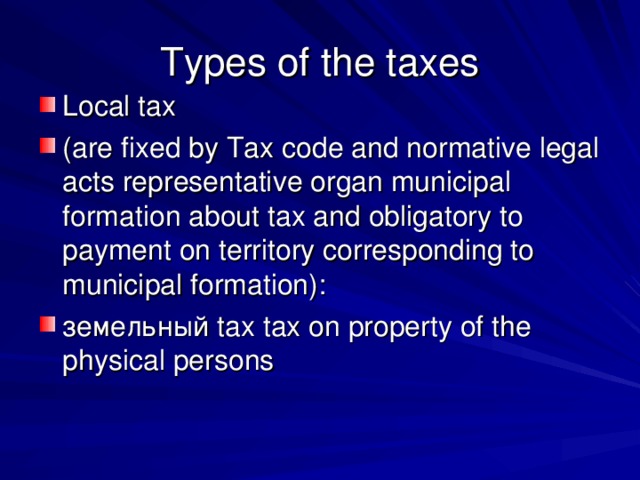

Tax this price, which we all pay for possibility to use the public facility for determined total integer, for instance, the defence and have an influence upon distribution incom and property between people.

Создайте Ваш сайт учителя Видеоуроки Олимпиады Вебинары для учителей

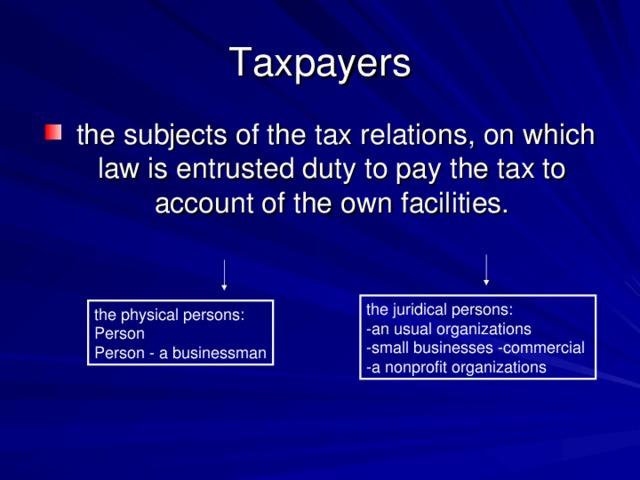

The Rights and duties of the taxpayer in RF

Вы уже знаете о суперспособностях современного учителя?

Тратить минимум сил на подготовку и проведение уроков.

Быстро и объективно проверять знания учащихся.

Сделать изучение нового материала максимально понятным.

Избавить себя от подбора заданий и их проверки после уроков.

Наладить дисциплину на своих уроках.

Получить возможность работать творчески.

Просмотр содержимого документа

«The Rights and duties of the taxpayer in RF»

Полезное для учителя

Распродажа видеоуроков!

1880 руб.

2690 руб.

1860 руб.

2660 руб.

2160 руб.

3080 руб.

1880 руб.

2690 руб.

ПОЛУЧИТЕ СВИДЕТЕЛЬСТВО МГНОВЕННО

* Свидетельство о публикации выдается БЕСПЛАТНО, СРАЗУ же после добавления Вами Вашей работы на сайт

Удобный поиск материалов для учителей

Проверка свидетельства